Accounts Receivable, without the friction

Create branded payment links with single or partial payments, custom labels, and status notifications.

Tailored payment experiences for your customers,

in just a few clicks

Tailored payment experiences for your customers, in just a few clicks

Payment Links reduce payment times by up to 99%. Create professional, customised payment links, with single or partial payment options. Track payment status and alert sales staff when paid.

Track Changes

Provide different access levels to sales staff, supervisors and managers. Payment links can be reviewed and tracked, facilitating ongoing reporting on individual and group sales performance.

Track Changes

Provide different access levels to sales staff, supervisors and managers. Payment links can be reviewed and tracked, facilitating ongoing reporting on individual and group sales performance.

Track Changes

Provide different access levels to sales staff, supervisors and managers. Payment links can be reviewed and tracked, facilitating ongoing reporting on individual and group sales performance.

Facilitate reconciliation

The combination of customer information and personalised labels makes book-keeping faster, cleaner, and easier.

Facilitate reconciliation

The combination of customer information and personalised labels makes book-keeping faster, cleaner, and easier.

Facilitate reconciliation

The combination of customer information and personalised labels makes book-keeping faster, cleaner, and easier.

Instant and secure payments with Pay by Bank

Pay by Bank is a real alternative to card payments, with lower fees,

instant settlement and zero chargebacks.

—

According to a report by the European Central Bank (ECB) published in September 2020, the adoption of Payment Initiation Services (PIS), which includes Pay by Bank, has been steadily increasing across Europe. See report

Instant and secure

When using Pay by Bank, your customer’s bank handles the transaction directly, eliminating the need to share card details with third parties. Pay by Bank offers a higher level of security compared to traditional card payments.

Instant and secure

When using Pay by Bank, your customer’s bank handles the transaction directly, eliminating the need to share card details with third parties. Pay by Bank offers a higher level of security compared to traditional card payments.

Instant and secure

When using Pay by Bank, your customer’s bank handles the transaction directly, eliminating the need to share card details with third parties. Pay by Bank offers a higher level of security compared to traditional card payments.

Customer driven

After logging in to their bank account, the end customer is presented with pre-populated payment details, including the amount and merchant information. No manual input is required, reducing the risk of errors and chargebacks.

Customer driven

After logging in to their bank account, the end customer is presented with pre-populated payment details, including the amount and merchant information. No manual input is required, reducing the risk of errors and chargebacks.

Customer driven

After logging in to their bank account, the end customer is presented with pre-populated payment details, including the amount and merchant information. No manual input is required, reducing the risk of errors and chargebacks.

Lower fees

With fixed transaction fees, rather than a percentage role, Pay by Bank is an economical alternative to card payments with direct-to-bottom-line advantages.

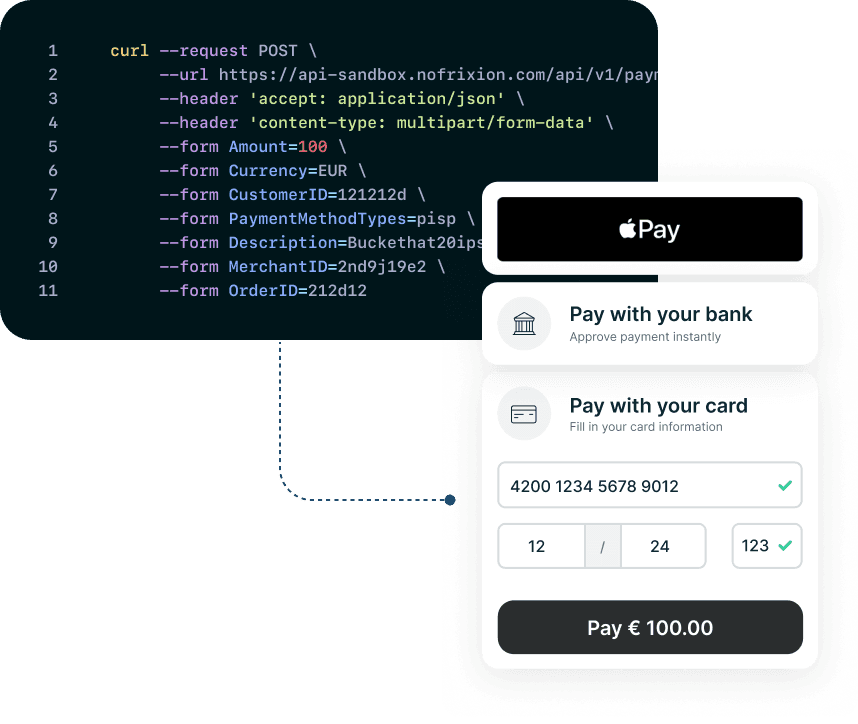

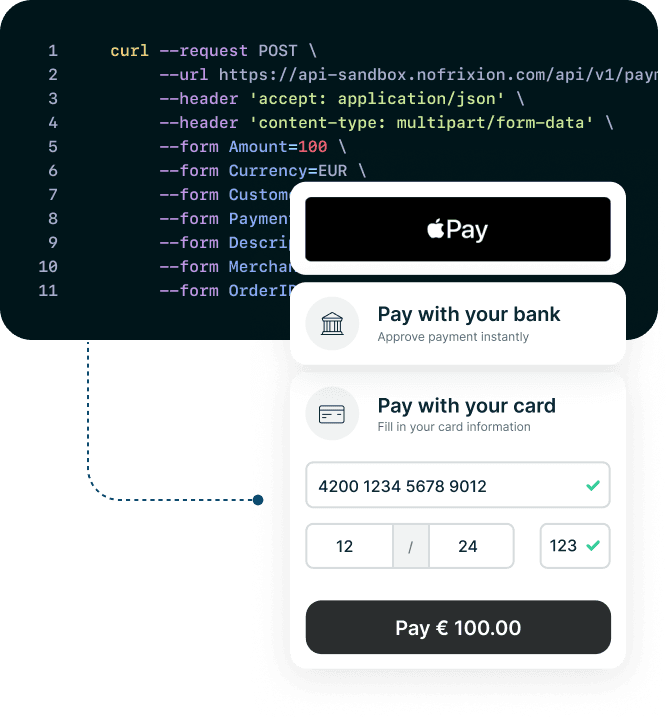

Meant for Automation

Automate money operations with our built-in rule engine or develop your own custom automations connecting your systems to our API.

Meant for Automation

Automate money operations with our built-in rule engine or develop your own custom automations connecting your systems to our API.

Meant for Automation

Automate money operations with our built-in rule engine or develop your own custom automations connecting your systems to our API.

Do you need help with accounts payable?

Eliminate spreadsheets and reduce the back and forth between systems, banking portals and approvers.

Do you need help with accounts payable?

Eliminate spreadsheets and reduce the back and forth between systems, banking portals and approvers.

Do you need help with accounts payable?

Eliminate spreadsheets and reduce the back and forth between systems, banking portals and approvers.

Break free from

traditional banking

Tell us your challenges, see a demo and let our team show you how even some small changes can have a big impact. The path to transformation starts with the first step.

Trusted by

Solutions

NoFrixion Ltd

8 Harcourt Street

Dublin 2

D02 AF58

Ireland

© 2026 NoFrixion · Registered in Ireland, Company No. 675705 ·

NoFrixion Ltd is authorised as an Electronic Money Institution (EMI) by the Central Bank of Ireland under firm reference number CBI00458163. Although the Central Bank of Ireland’s Deposit Guarantee Scheme does not apply to Electronic Money Institutions, NoFrixion ensures the full protection of customer funds, in line with regulatory requirements. NoFrixion is compliant with the Payment Card Industry - Data Security Standard (PCI-DSS), maintaining the highest standards for payment security.

Break free from traditional banking

Tell us your challenges, see a demo and let our team show you how even some small changes can have a big impact. The path to transformation starts with the first step.

Solutions

NoFrixion Ltd

8 Harcourt Street

Dublin 2

D02 AF58

Ireland

© 2026 NoFrixion · Registered in Ireland, Company No. 675705 ·

NoFrixion Ltd is authorised as an Electronic Money Institution (EMI) by the Central Bank of Ireland under firm reference number CBI00458163. Although the Central Bank of Ireland’s Deposit Guarantee Scheme does not apply to Electronic Money Institutions, NoFrixion ensures the full protection of customer funds, in line with regulatory requirements. NoFrixion is compliant with the Payment Card Industry - Data Security Standard (PCI-DSS), maintaining the highest standards for payment security.

Break free from

traditional banking

Tell us your challenges, see a demo and let our team show you how even some small changes can have a big impact. The path to transformation starts with the first step.

Solutions

NoFrixion Ltd

8 Harcourt Street

Dublin 2

D02 AF58

Ireland

© 2026 NoFrixion · Registered in Ireland, Company No. 675705 ·

NoFrixion Ltd is authorised as an Electronic Money Institution (EMI) by the Central Bank of Ireland under firm reference number CBI00458163. Although the Central Bank of Ireland’s Deposit Guarantee Scheme does not apply to Electronic Money Institutions, NoFrixion ensures the full protection of customer funds, in line with regulatory requirements. NoFrixion is compliant with the Payment Card Industry - Data Security Standard (PCI-DSS), maintaining the highest standards for payment security.