Accounts Payable, without the friction

Accounts Payable,

without the friction

Eliminate spreadsheets and reduce the back and forth between systems, banking portals and approvers.

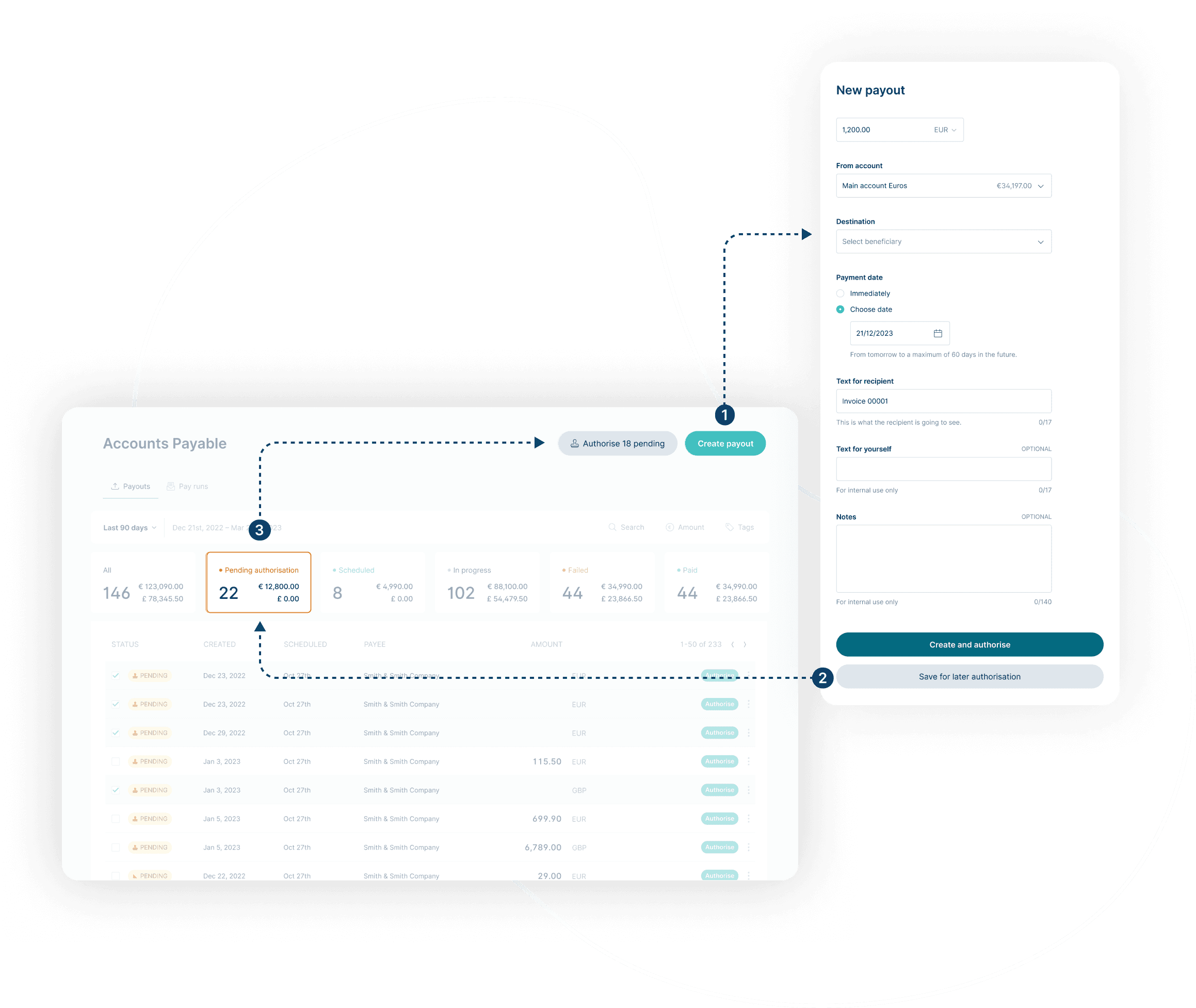

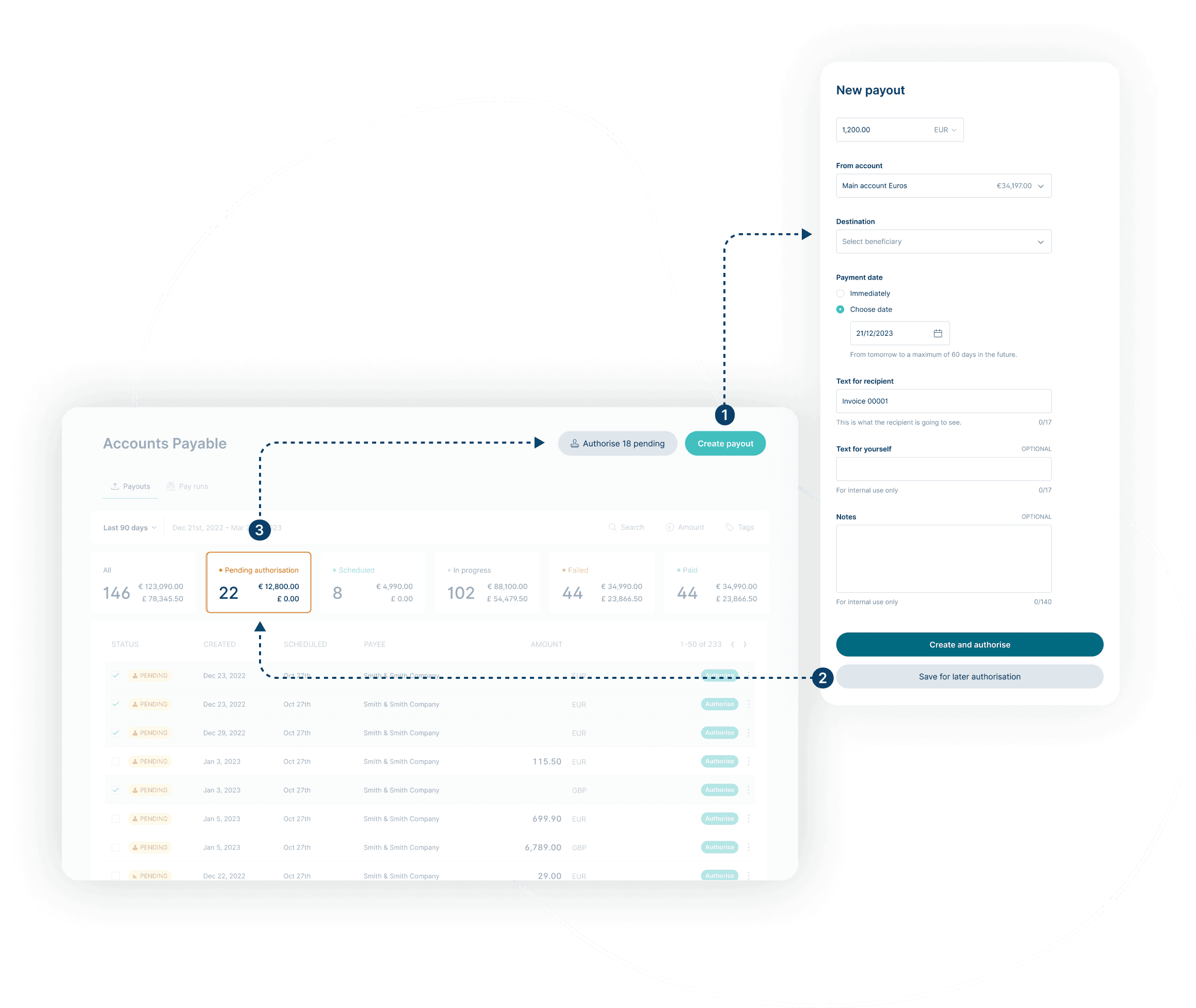

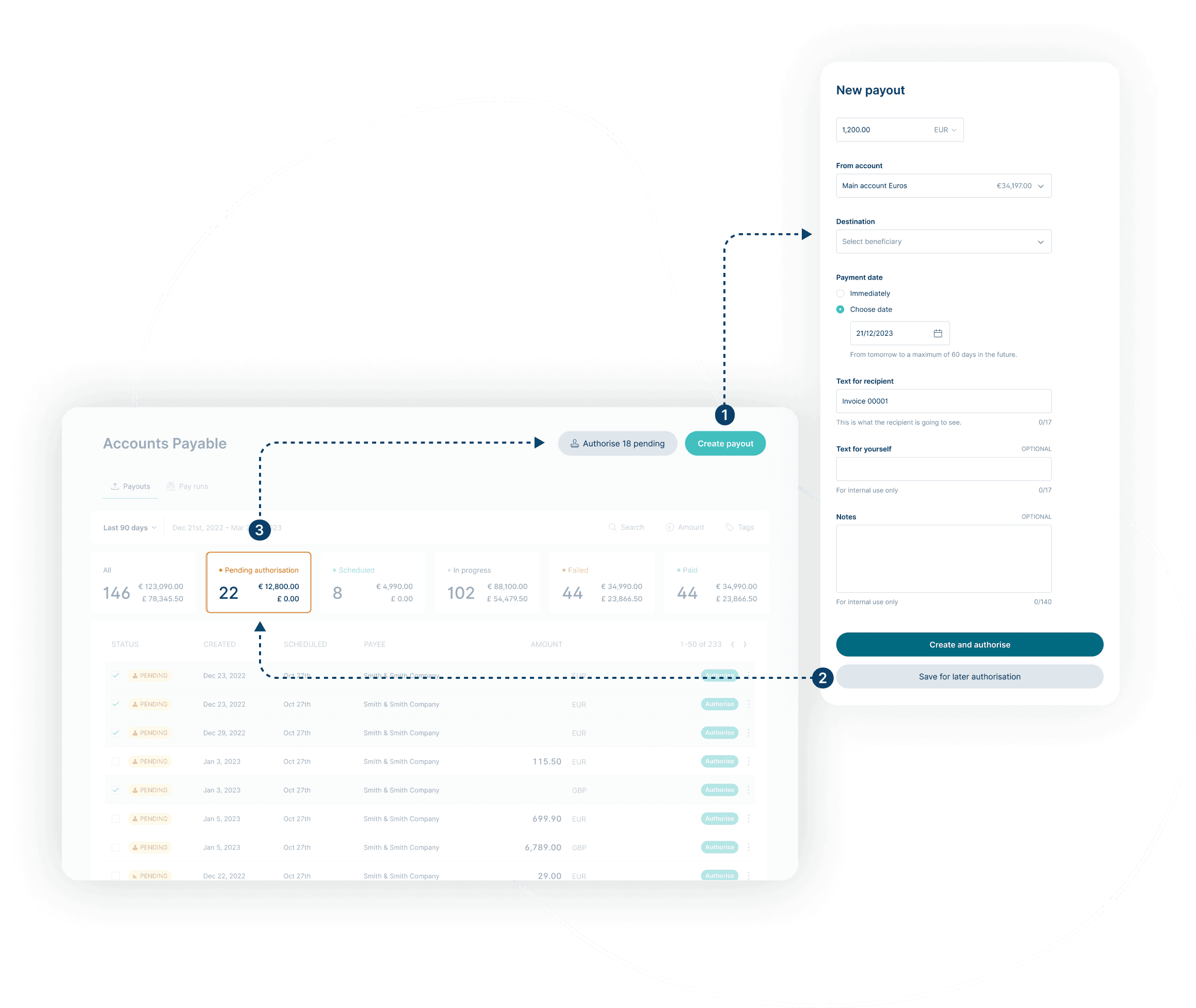

Integrated payment and authorisation workflow

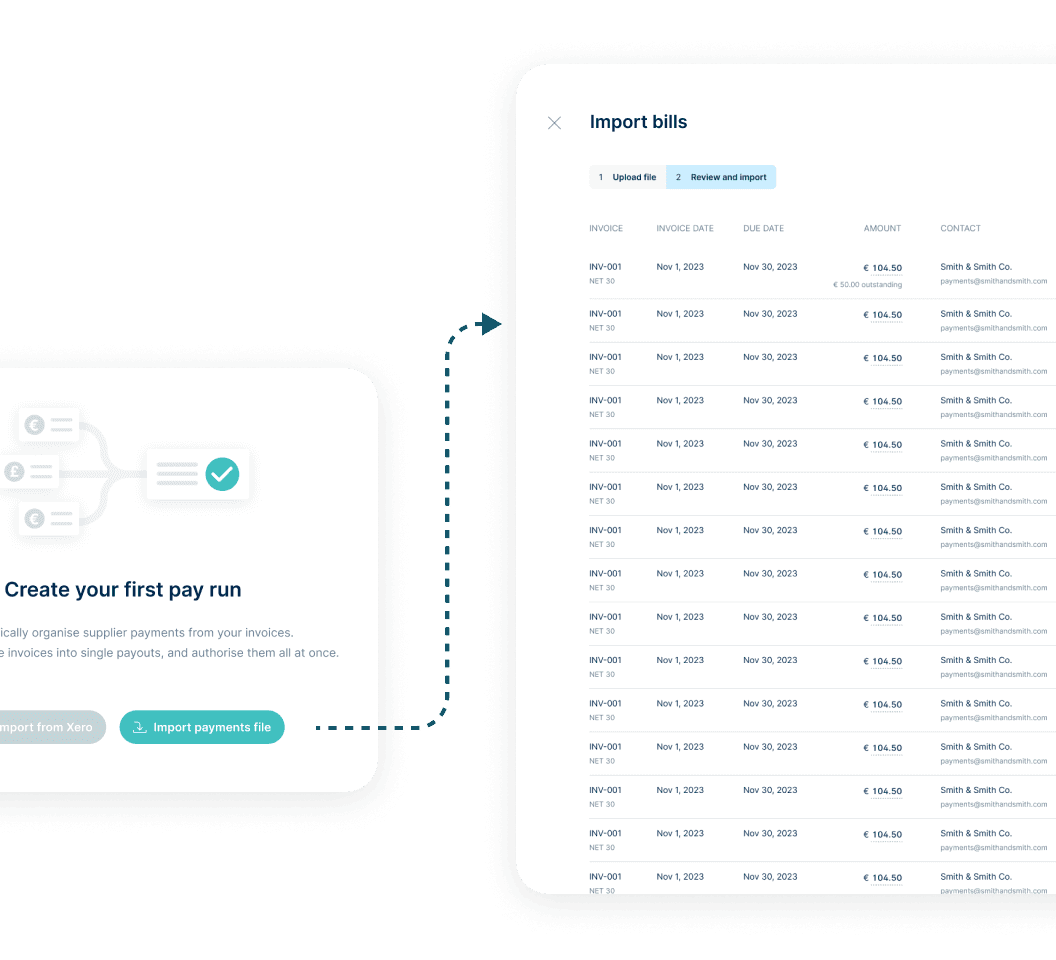

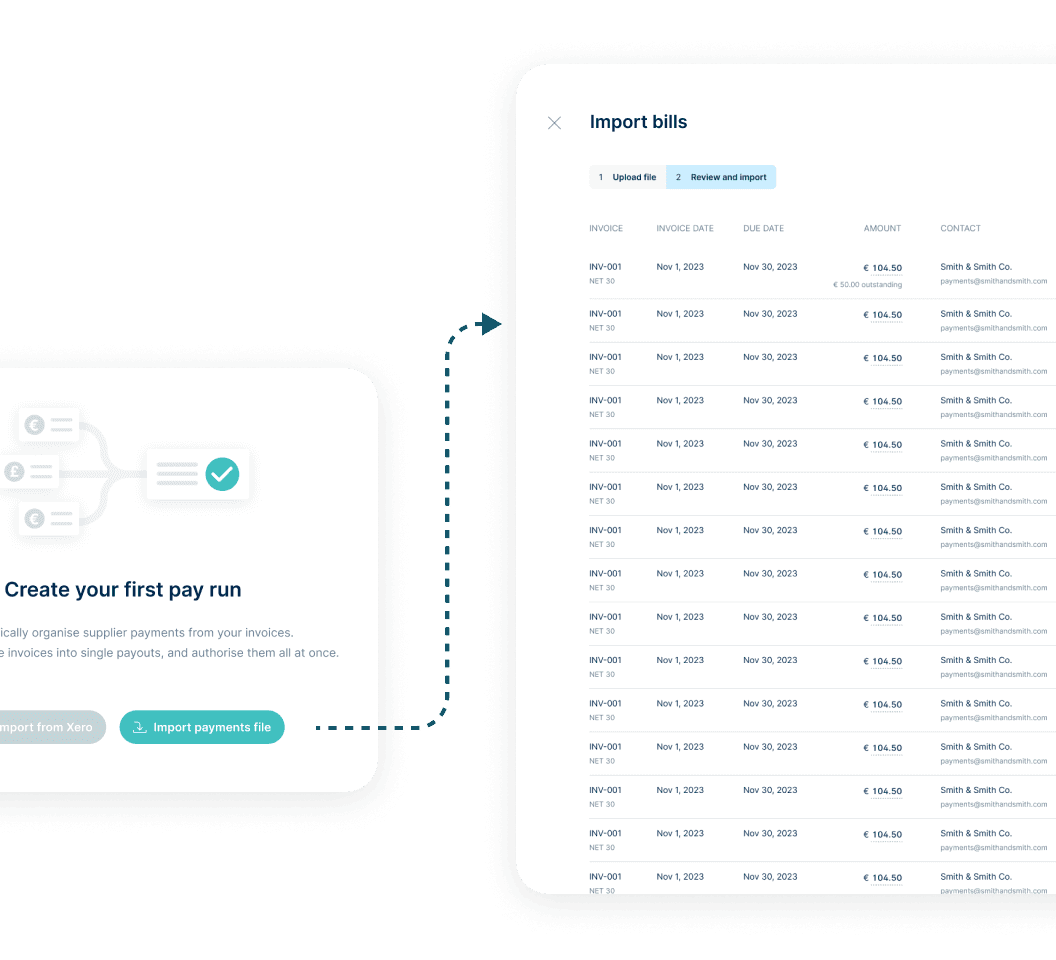

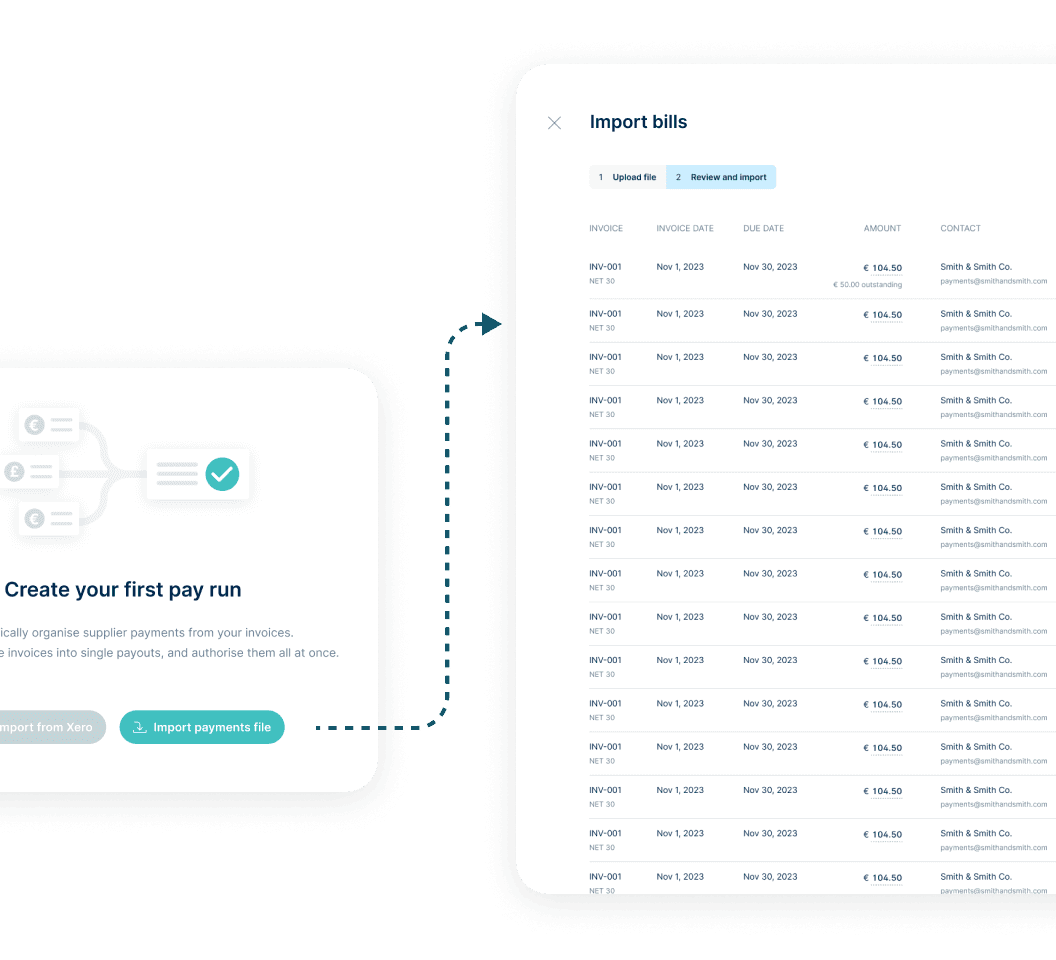

Bills to payments

Import invoices to pay from XERO or any software, manage supplier payments, and approval workflows easily. Auto-grouping into single payments per supplier improves efficiency and saves time.

Bills to payments

Import invoices to pay from XERO or any software, manage supplier payments, and approval workflows easily. Auto-grouping into single payments per supplier improves efficiency and saves time.

Bills to payments

Import invoices to pay from XERO or any software, manage supplier payments, and approval workflows easily. Auto-grouping into single payments per supplier improves efficiency and saves time.

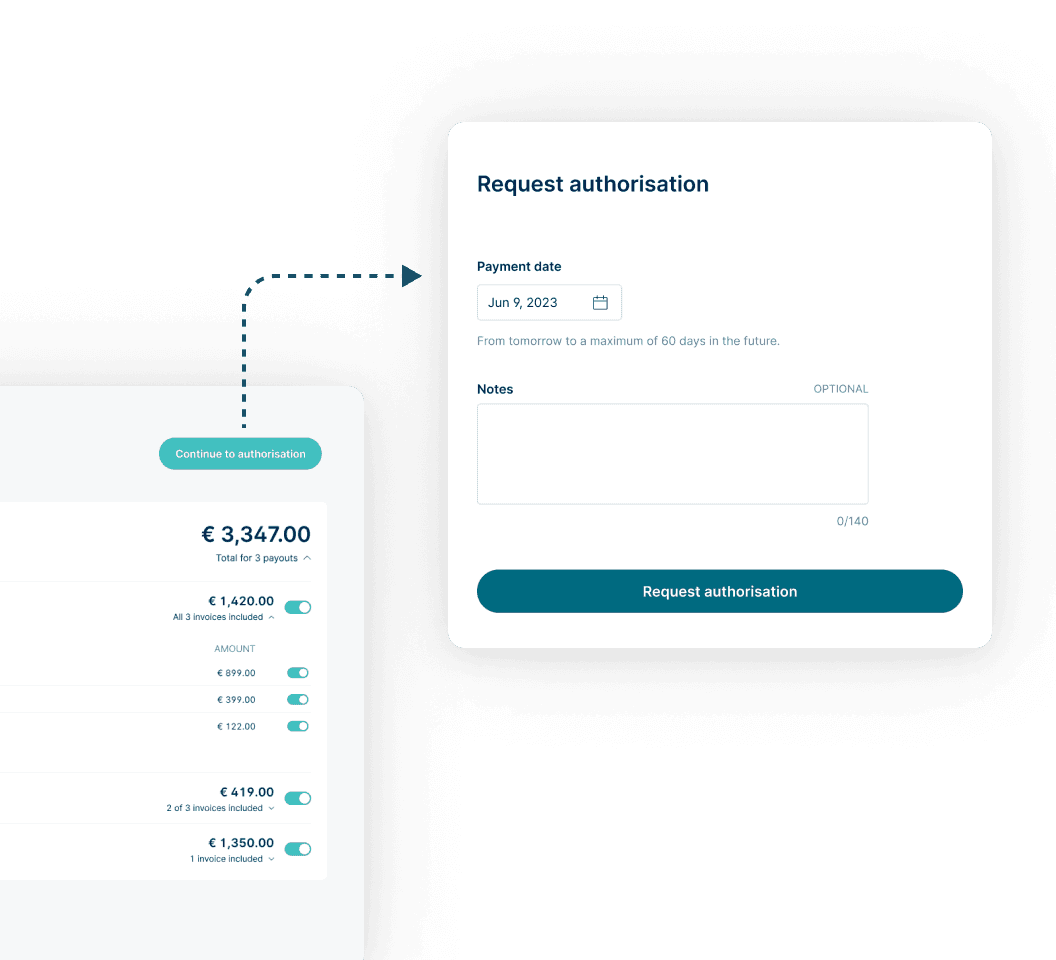

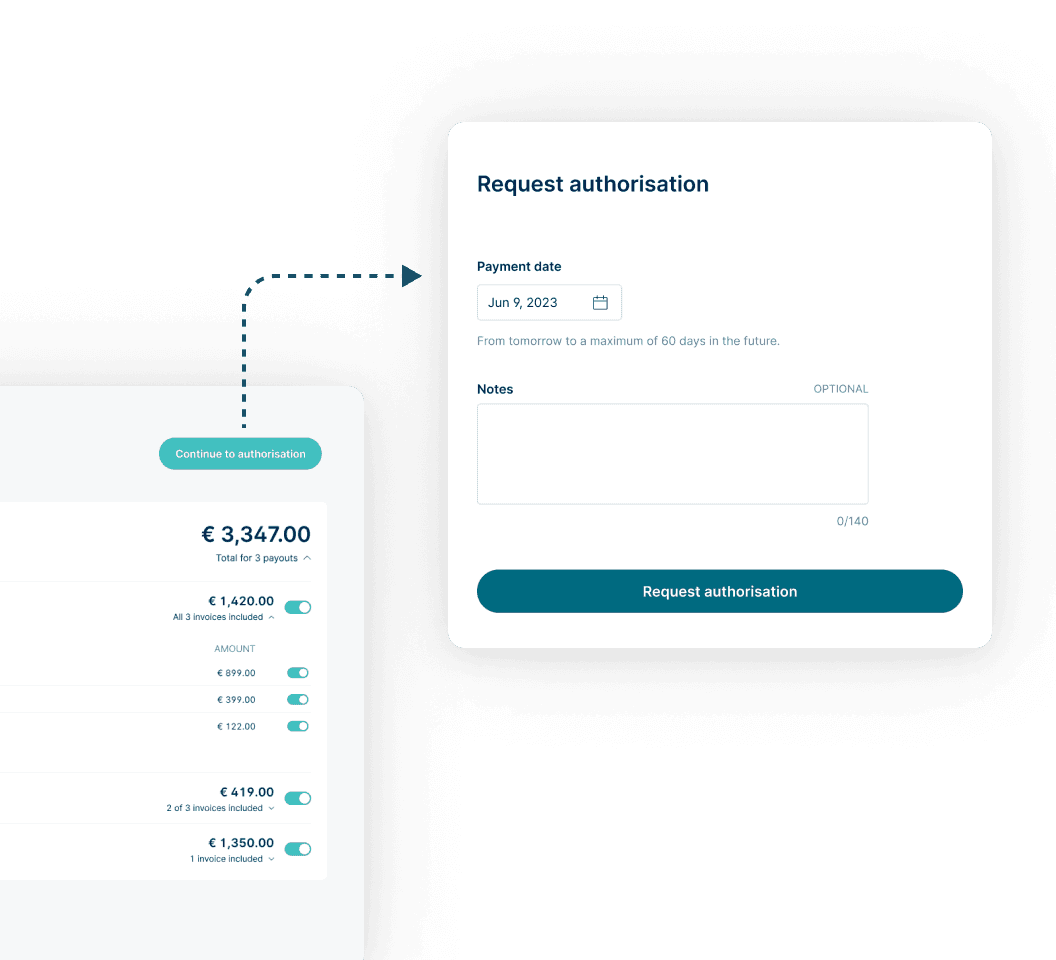

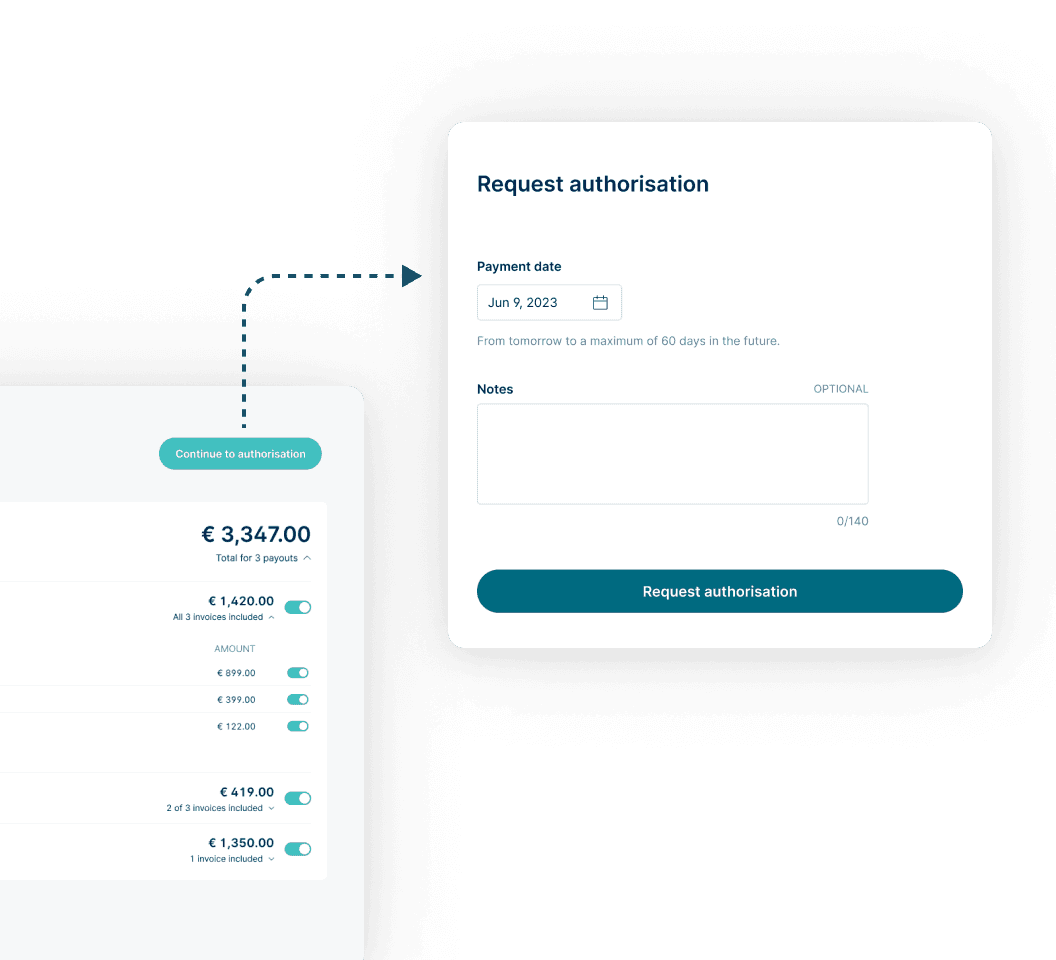

Request authorisation

Before sending for authorisation, review and adjust the resulting payouts. Include optional notes if clarification is needed.

Request authorisation

Before sending for authorisation, review and adjust the resulting payouts. Include optional notes if clarification is needed.

Request authorisation

Before sending for authorisation, review and adjust the resulting payouts. Include optional notes if clarification is needed.

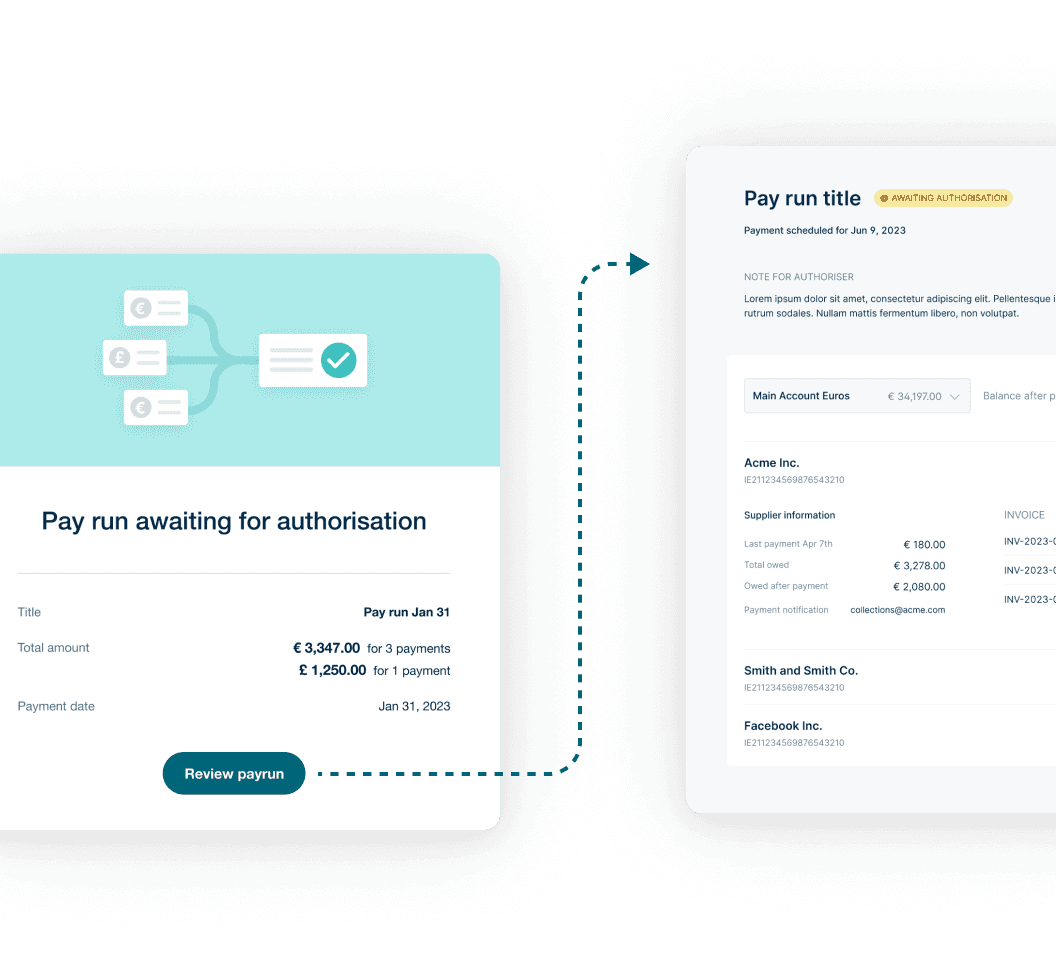

Authoriser’s view

The authorizer gets an email asking for approval, with a clear summary of pay run details for a streamlined authorisation process.

Authoriser’s view

The authorizer gets an email asking for approval, with a clear summary of pay run details for a streamlined authorisation process.

Authoriser’s view

The authorizer gets an email asking for approval, with a clear summary of pay run details for a streamlined authorisation process.

One solution, multiple ways to streamline payments

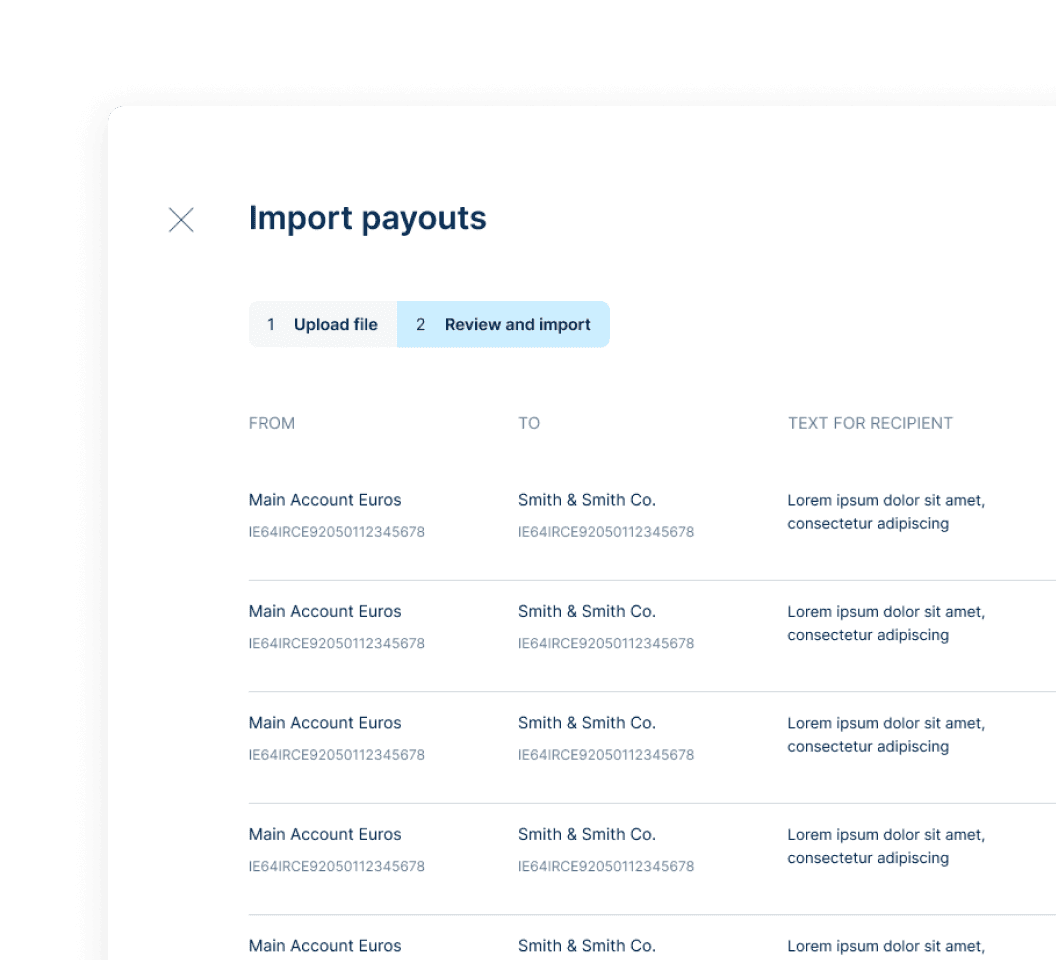

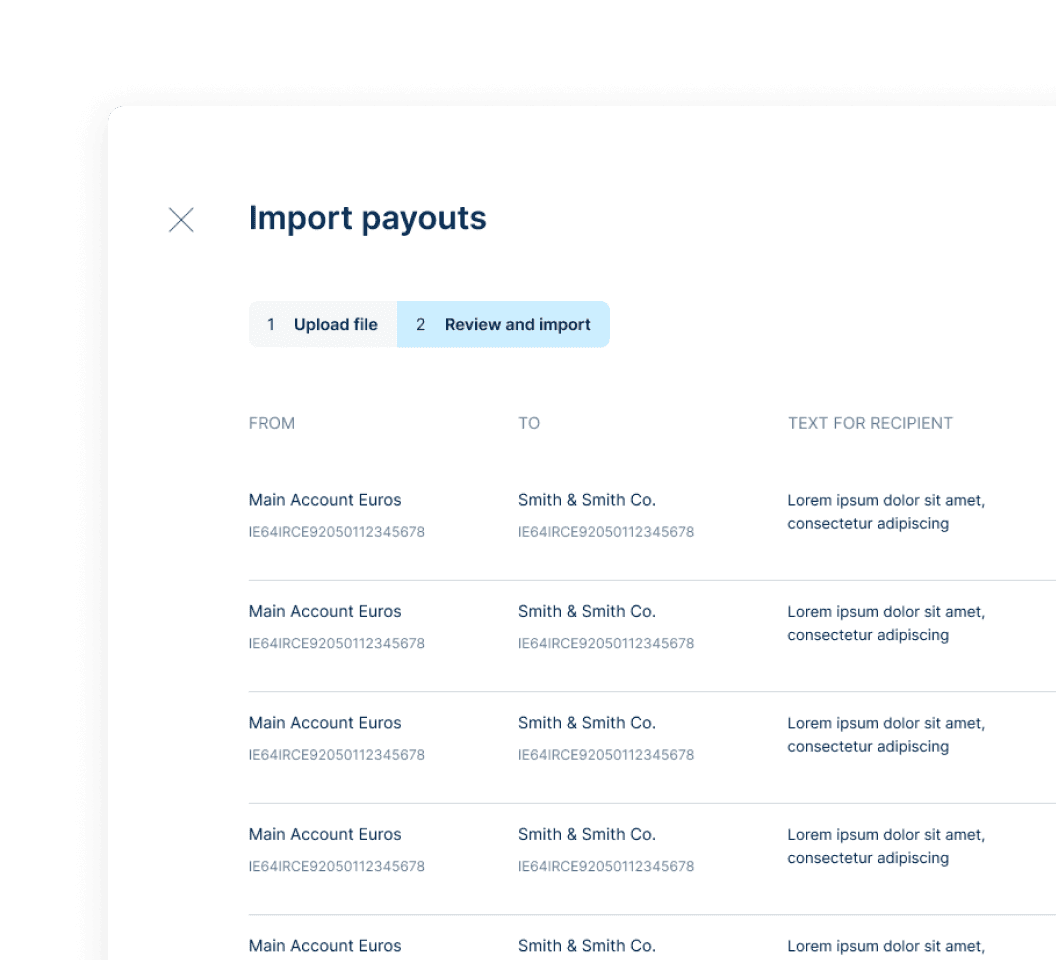

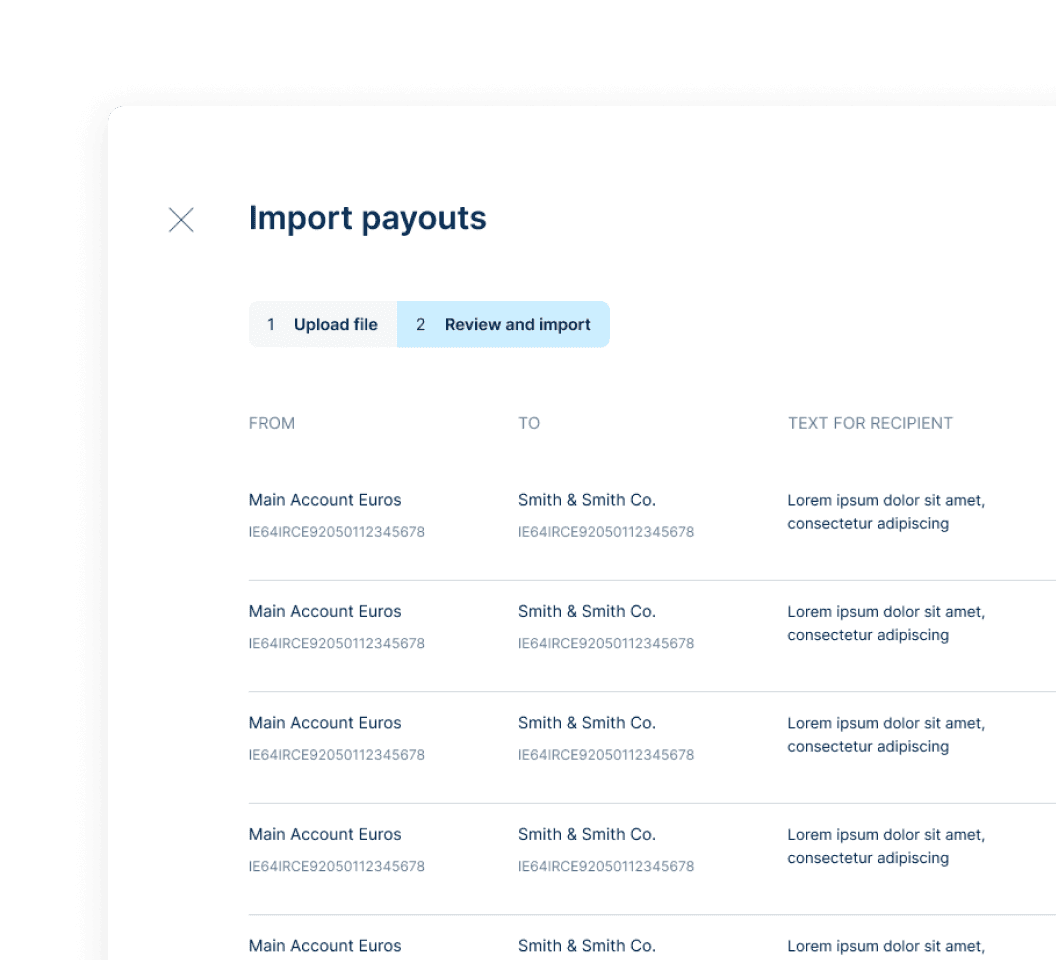

Batch import

Simplify your payout process by importing batch files directly into the platform. Upload your payment details, review, and process them all at once, saving time and enhancing efficiency.

Batch import

Simplify your payout process by importing batch files directly into the platform. Upload your payment details, review, and process them all at once, saving time and enhancing efficiency.

Batch import

Simplify your payout process by importing batch files directly into the platform. Upload your payment details, review, and process them all at once, saving time and enhancing efficiency.

Batch authorisation

Streamline payment approvals with batch authorisation. Quickly verify payment information and authorise payouts in one simple action, enhancing speed without compromising on security.

Batch authorisation

Streamline payment approvals with batch authorisation. Quickly verify payment information and authorise payouts in one simple action, enhancing speed without compromising on security.

Batch authorisation

Streamline payment approvals with batch authorisation. Quickly verify payment information and authorise payouts in one simple action, enhancing speed without compromising on security.

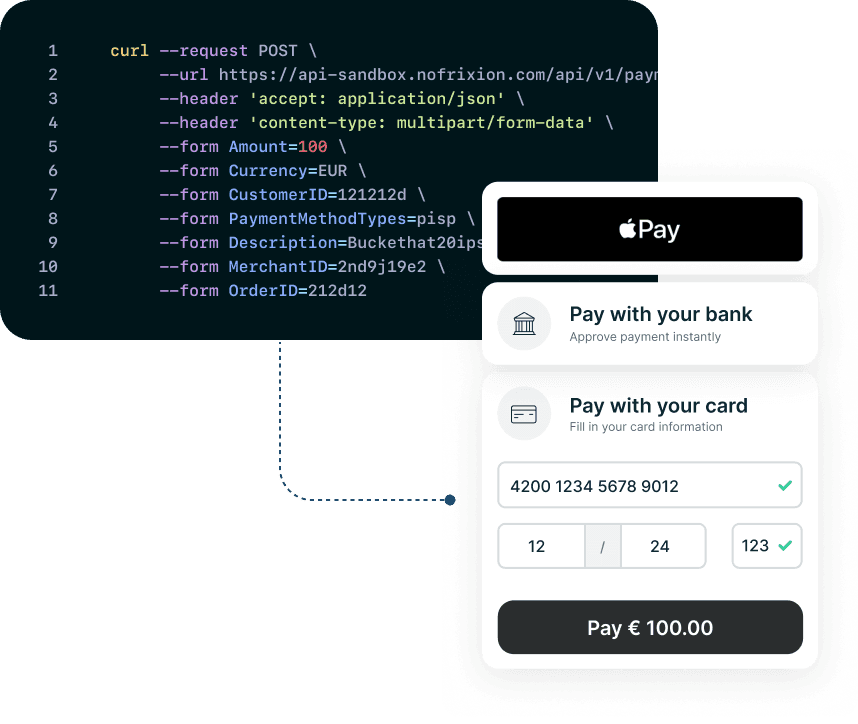

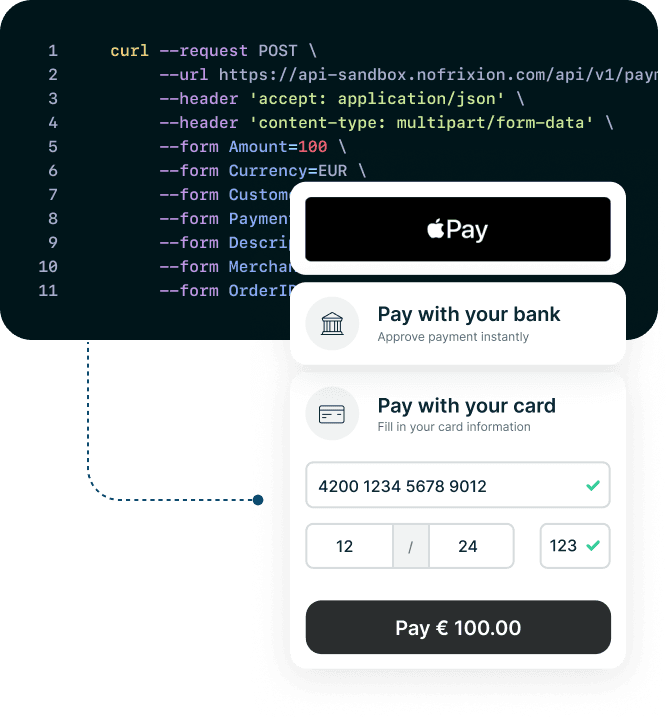

Meant for Automation

Automate money operations with our built-in rule engine or develop your own custom automations connecting your systems to our API.

Meant for Automation

Automate money operations with our built-in rule engine or develop your own custom automations connecting your systems to our API.

Meant for Automation

Automate money operations with our built-in rule engine or develop your own custom automations connecting your systems to our API.

Do you need help with Accounts Receivable?

Create branded payment links with single or partial payments, custom labels, and status notifications. Combine cards, wallets, and boost conversions reducing costs with Pay By Bank.

Break free from

traditional banking

Tell us your challenges, see a demo and let our team show you how even some small changes can have a big impact. The path to transformation starts with the first step.

Trusted by

Solutions

NoFrixion Ltd

8 Harcourt Street

Dublin 2

D02 AF58

Ireland

© 2026 NoFrixion · Registered in Ireland, Company No. 675705 ·

NoFrixion Ltd is authorised as an Electronic Money Institution (EMI) by the Central Bank of Ireland under firm reference number CBI00458163. Although the Central Bank of Ireland’s Deposit Guarantee Scheme does not apply to Electronic Money Institutions, NoFrixion ensures the full protection of customer funds, in line with regulatory requirements. NoFrixion is compliant with the Payment Card Industry - Data Security Standard (PCI-DSS), maintaining the highest standards for payment security.

Break free from traditional banking

Tell us your challenges, see a demo and let our team show you how even some small changes can have a big impact. The path to transformation starts with the first step.

Solutions

NoFrixion Ltd

8 Harcourt Street

Dublin 2

D02 AF58

Ireland

© 2026 NoFrixion · Registered in Ireland, Company No. 675705 ·

NoFrixion Ltd is authorised as an Electronic Money Institution (EMI) by the Central Bank of Ireland under firm reference number CBI00458163. Although the Central Bank of Ireland’s Deposit Guarantee Scheme does not apply to Electronic Money Institutions, NoFrixion ensures the full protection of customer funds, in line with regulatory requirements. NoFrixion is compliant with the Payment Card Industry - Data Security Standard (PCI-DSS), maintaining the highest standards for payment security.

Break free from

traditional banking

Tell us your challenges, see a demo and let our team show you how even some small changes can have a big impact. The path to transformation starts with the first step.

Solutions

NoFrixion Ltd

8 Harcourt Street

Dublin 2

D02 AF58

Ireland

© 2026 NoFrixion · Registered in Ireland, Company No. 675705 ·

NoFrixion Ltd is authorised as an Electronic Money Institution (EMI) by the Central Bank of Ireland under firm reference number CBI00458163. Although the Central Bank of Ireland’s Deposit Guarantee Scheme does not apply to Electronic Money Institutions, NoFrixion ensures the full protection of customer funds, in line with regulatory requirements. NoFrixion is compliant with the Payment Card Industry - Data Security Standard (PCI-DSS), maintaining the highest standards for payment security.